(UroToday.com) The 2024 GU ASCO annual meeting featured a session on the shortage of drugs for urothelial carcinoma and a presentation by Dr. Josh Meeks discussing what is on the horizon to replace BCG. Dr. Meeks started his presentation with a case report of a 71 year old female who presented with gross hematuria and a CT scan showing a 3 cm bladder mass. A TURBT demonstrated T1 high grade urothelial carcinoma with CIS and with muscle in the specimen. A re-TURBT demonstrated only CIS. Dr. Meeks notes that in this situation the hospital has limited BCG available: there is an option to start BCG, but at only 1/3 the dose and you do not know if you can provide BCG through year 1. What do you recommend? Several options, which are all rational for this patient, include:

- Push forward with BCG and cross your fingers

- Gemcitabine + Docetaxel

- Enroll the patient in a clinical trial

- Consider a radical cystectomy

Dr. Meeks then discussed the BCG shortage timeline and production challenges. This started in 2012 with the FDA temporarily stopping the Sanofi Pasteur factory due to manufacturing and sterility issues. Subsequently, in 2016, the AUA NMIBC guidelines recommended BCG induction and 36 months of maintenance therapy. In 2017, Sanofi Pasteur ceased US production of TheraCys and ImmuCyst BCG, and in 2019, Merck and company, the sole producer of BCG in Australia and the USA were unable to meet the demands, despite increased production from 200,000 to > 870,000 vials of BCG per year. There are several reasons why it is so hard to make BCG:

- It is a slow production process: the doubling time of the bacterium is > 16 hours (vs 20 minutes for E. coli, for example), and each batch takes 3 months, with strict quality control

- High doses are needed compared to vaccines

- There is little financial incentive

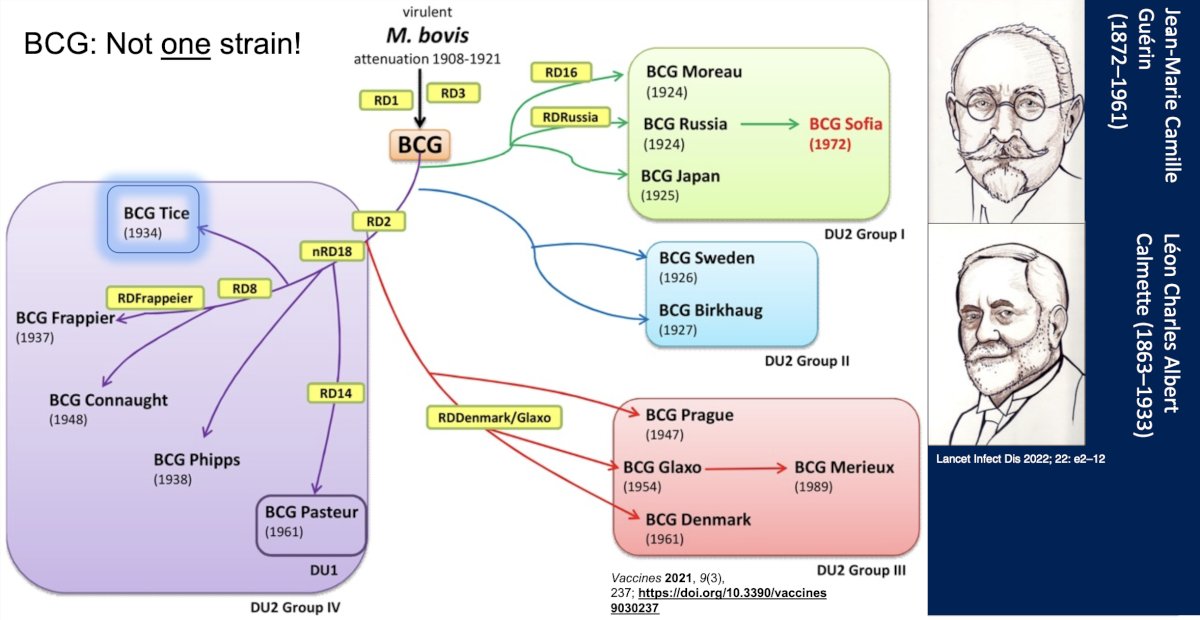

Taken together, the main problem according to Dr. Meeks is that there is unequal, unpredictable BCG distribution. However, there is more than one BCG strain, highlighted as follows:

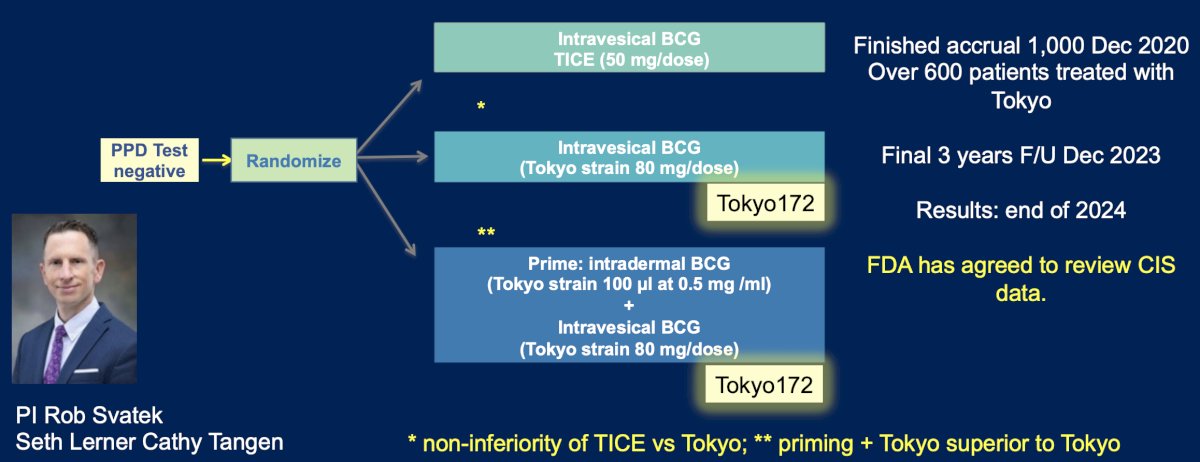

The S1602 trial is assessing if the Tokyo172 strain is as good as TICE, with the following trial design:

This trial finished accrual of 1,000 patients in December 2020, with over 600 patients treated with the Tokyo strain. The final three years of follow-up were completed in December 2023, with results likely by the end of 2024. Of note, the FDA has agreed to review the CIS data.

Dr. Meeks emphasized that the combination of intravesical gemcitabine + docetaxel is arguably the closest therapy to providing a replacement for BCG. Steinberg and colleagues1 in 2020 published their multi-institutional evaluation of gemcitabine + docetaxel among 276 patients (38% BCG unresponsive, 37% relapsing, and 8% intolerant) that had previously received BCG therapy. They found that the 1- and 2-year recurrence-free survival rates were 60% and 46%, and high-grade recurrence-free survival rates were 65% and 52%, respectively. There were 10 patients (3.6%) that had disease progression on transurethral resection, and 43 patients (15.6%) went on to cystectomy (median 11.3 months from induction), of whom 11 (4.0%) had progression to muscle invasion.

Gemcitabine + docetaxel may also have a potential role as standard of care in the BCG-naïve population. McElree and colleagues [2] evaluated 312 patients with high-risk treatment-naive NMIBC, including 174 patients treated with BCG therapy and 138 treated with gemcitabine and docetaxel therapy. High-grade RFS estimates were 76% (95% CI, 69%-82%) at 6 months, 71% (95% CI, 64%-78%) at 12 months, and 69% (95% CI, 62%-76%) at 24 months in the BCG group, and 92% (95% CI, 86%-95%) at 6 months, 85% (95% CI, 78%-91%) at 12 months, and 81% (95% CI, 72%-87%) at 24 months in the gemcitabine and docetaxel group:

As such, gemcitabine + docetaxel therapy was associated with less high grade disease recurrence and treatment discontinuation than BCG therapy.

Dr. Meeks emphasized that there are several pros of gemcitabine + docetaxel, including that (i) in many parts of the US, it is already standard of care, (ii) it is very cheap, (iii) it may be better tolerated than BCG, and (iv) it is not dependent on the immune system. However, there are cons, including that (i) it is not currently FDA approved, (ii) there is non-uniform availability, (iii) it is associated with a longer treatment time, (iv) nursing logistics may be a barrier, and (v) there is a need for prospective data. As such, there is a prospective trial assessing BCG versus gemcitabine + docetaxel ongoing, the EA8212 BRIDGE trial. Among BCG naïve patients, 870 patients are being randomized to Arm A (gemcitabine + docetaxel) versus Arm B (BCG), with an objective to assess whether event-free survival is non-inferior for gemcitabine + docetaxel versus standard BCG.

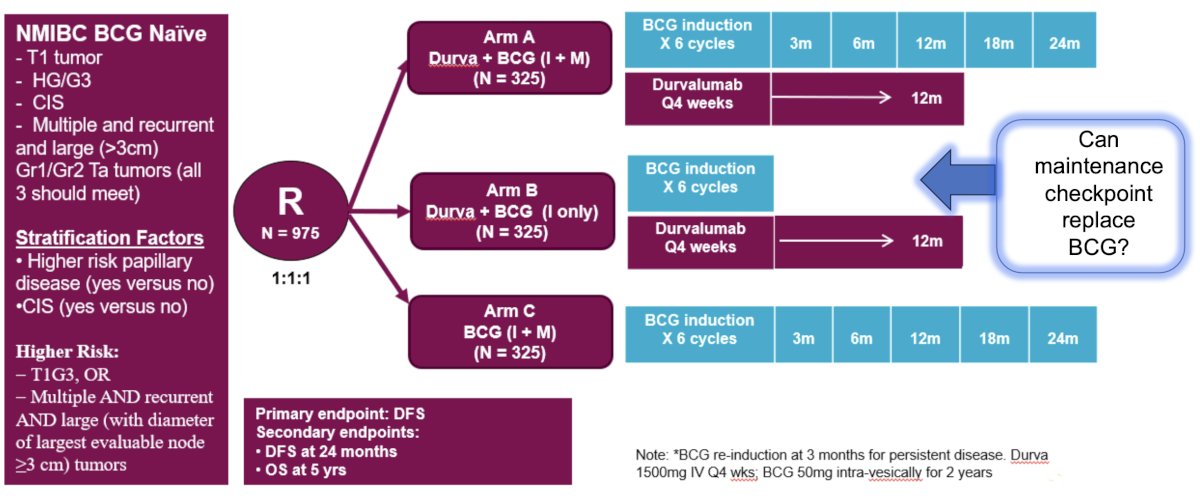

With regards to whether immune checkpoint inhibitors may help these patients, Dr. Meeks highlighted the POTOMAC trial, which has completed recruitment and is awaiting result read out. This trial randomized 975 patients 1:1:1 to durvalumab + BCG (intravesical + muscular) versus durvalumab + BCG (intravesical only) versus BCG (intravesical + muscular). The primary endpoint is disease free survival, with the following trial design:

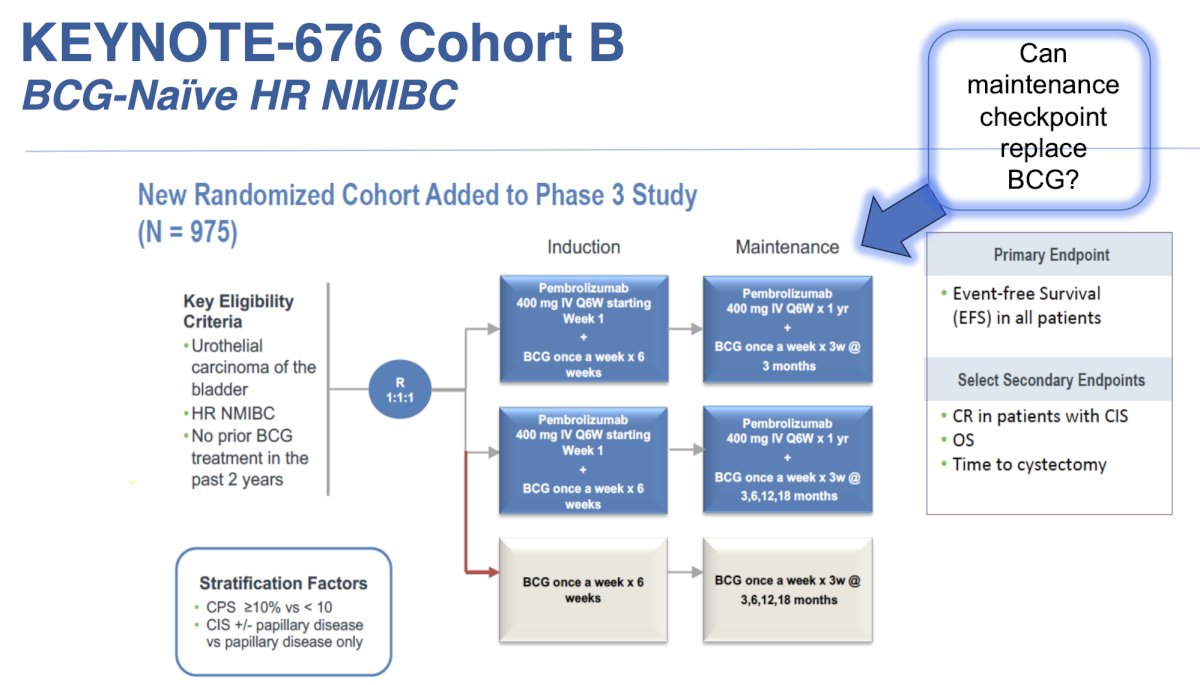

The KEYNOTE-676 cohort B trial is assessing 975 patients with BCG naïve high risk NMIBC, randomizing participants 1:1:1 to various combinations of pembrolizumab + BCG induction + maintenance. The primary outcome is event free survival with the following trial design:

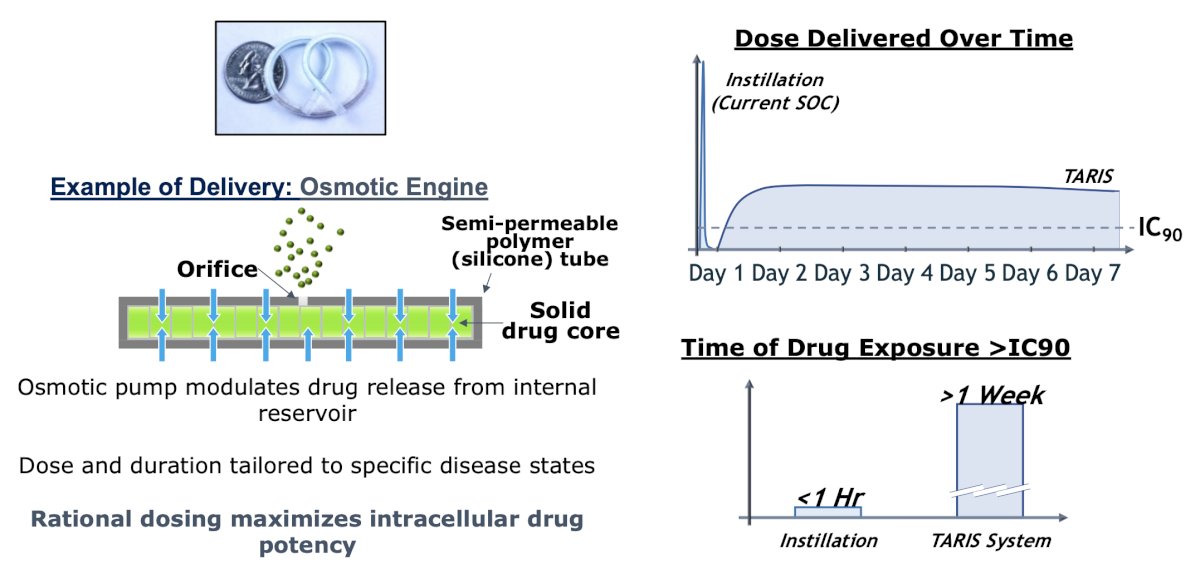

Dr. Meeks notes that perhaps new devices will challenge the BCG standard of care. For example, the TARIS system allows controlled drug delivery, with the following mechanism and pharmacokinetics:

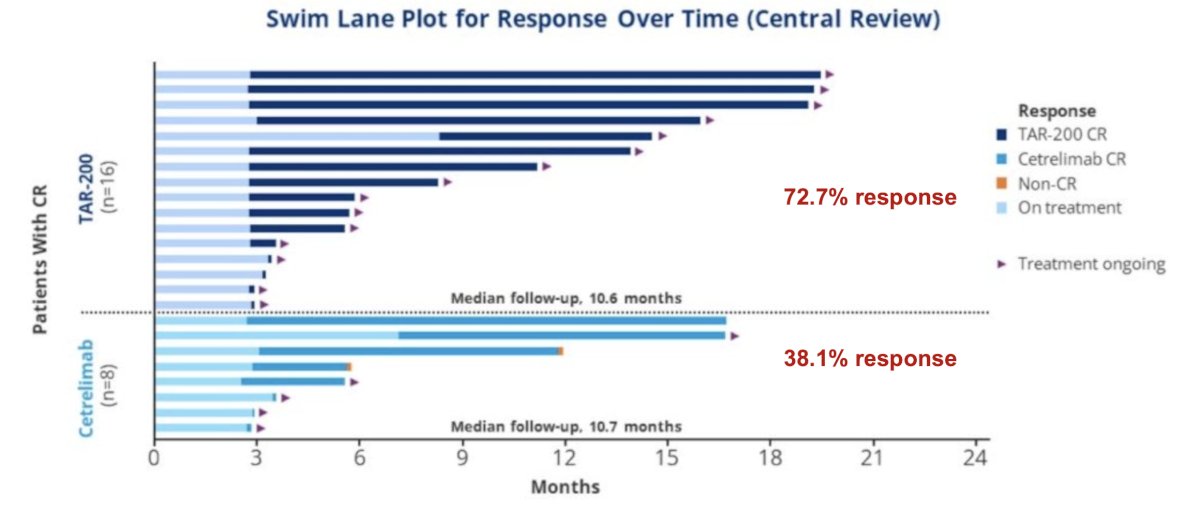

The SunRISe-1 trial was first presented by Dr. Daneshmand at AUA 2023, a randomized trial of BCG-unresponsive HR NMIBC CIS patients (+/- papillary disease) who did not receive a radical cystectomy. Patients underwent stratified randomization (by presence or absence of concomitant papillary disease) in a 2:1:1 fashion to either:

- Cohort 1: TAR-200 + cetrelimab (PD-1 inhibitor)

- Cohort 2: TAR-200 alone (target sample size 50, currently enrolled: 23)

- Cohort 3: Cetrelimab alone (target sample size 50, currently enrolled: 24)

There were 73% of patients in the TAR-200 arm that achieved a complete response, defined based on the results of cystoscopy, centrally assessed urine cytology, and mandated biopsy at weeks 24 and 48. The complete response rate in the cetrelimab arm was 38%, and the median duration of response with TAR-200 has not been reached yet after a median follow-up of ~11 months

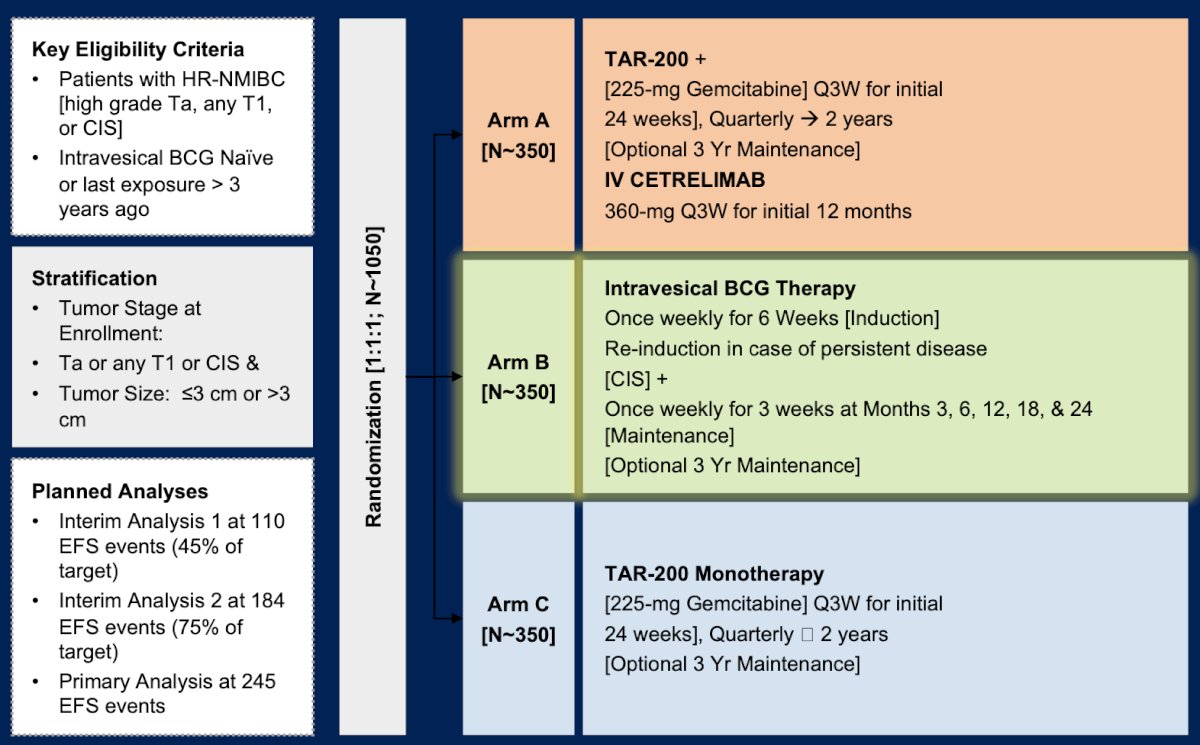

Dr. Meeks then discussed the SunRISe-3 phase 3 trial, which is assessing TAR-200 + IV cetrelimab among high risk NMIBC in BCG naïve patients. This is a 3 arm trial with the following trial design:

There may also be a rationale for applying BCG unresponsive therapies to BCG naïve tumors. Nadofaragene firadenovec (adstiladrin) was FDA approved in 2021 for BCG unresponsive NMIBC and is currently available in some areas in the US. The response rate in the BCG unresponsive disease state is 53% for CIS, with a 45% maintained response at 12 months [3], however nadofaragene firadenovec has not been tested in the BCG naïve setting. Cretostimogene grenadenorepvec (GC0070) was reported at SUO 2023 (BOND003 trial), with a complete response rate of 76%, and 75% maintaining their response for > 6 months. This treatment has been granted fast track and breakthrough status from the FDA for BCG unresponsive NMIBC, but has not been tested in the BCG-naïve setting (although PIVOT-006 is evaluating cretostimogene grenadenorepvec in BCG-naïve intermediate risk NMIBC).

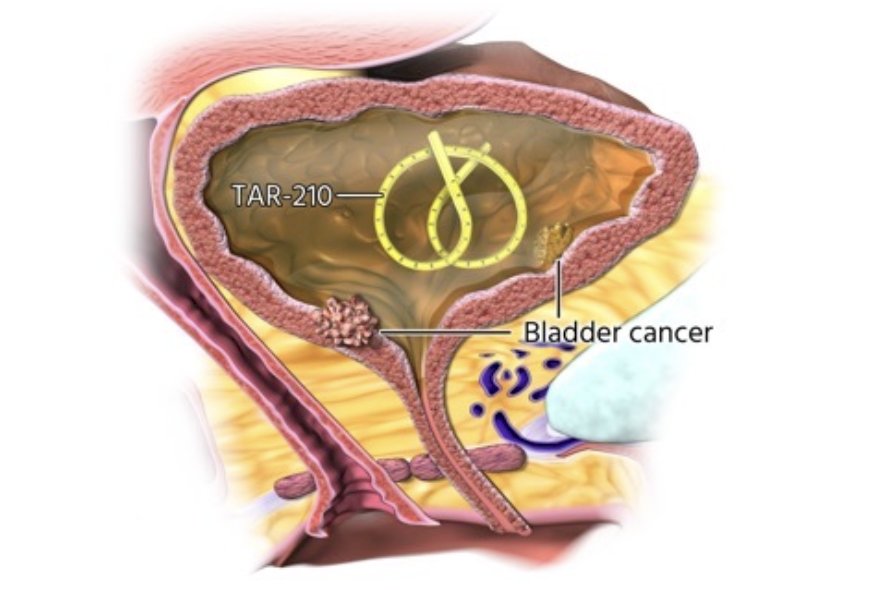

Precision oncology is also on the horizon, specifically TAR-210 as a novel drug delivery system designed to provide local targeted therapy for patients with FGFR mutated bladder cancer. TAR-210 is designed to provide local, sustained release of erdafitinib within the bladder for 3 months while limiting systemic toxicities. It is inserted into the bladder through a dedicated urinary placement catheter and removed via cystoscopy:

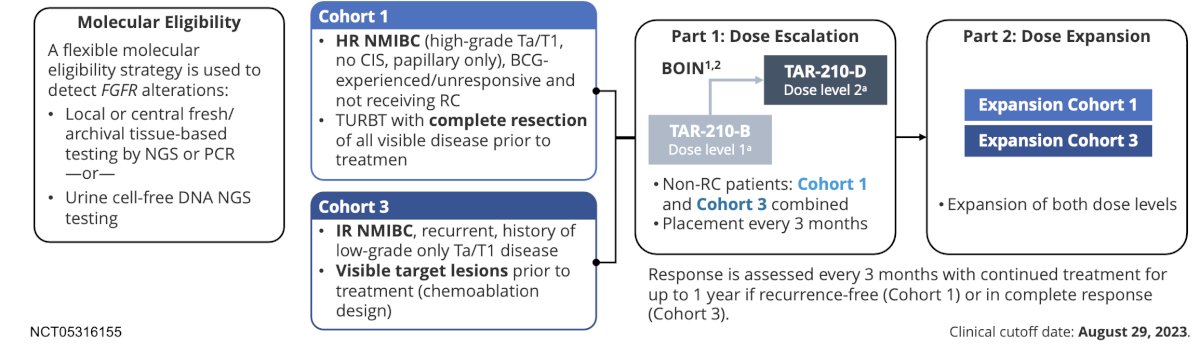

Currently, there is an open-label, multicenter, phase 1 study evaluating safety, pharmacokinetics, and efficacy of TAR-210 with the following study design:

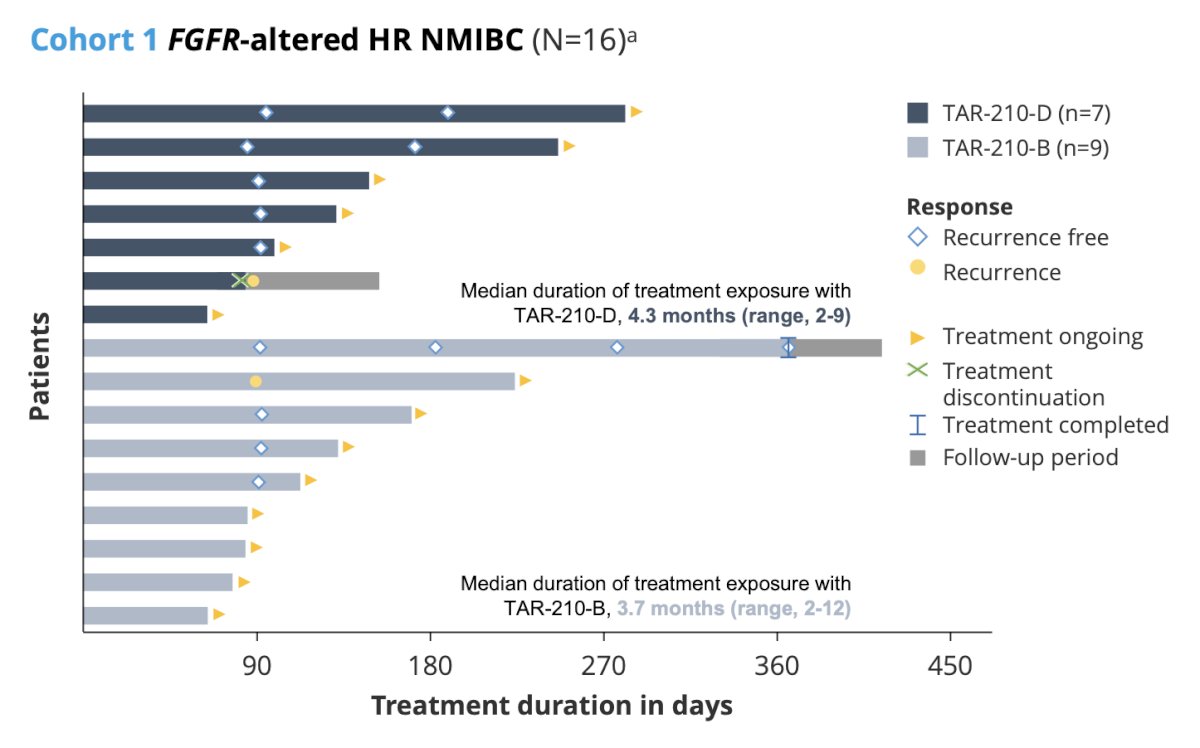

Data from cohort 1 were presented by Velaseca and colleagues at ESMO 2023, noting that in 11 patients with a response assessment, 9 were recurrence free (recurrence-free rate of 82%). Additionally, the median recurrence free survival was not reached (95% CI 2.96 months – not reached):

Dr. Meeks concluded his presentation discussing what is on the horizon to replace BCG with the following take-home points:

- Some very near horizon therapies may increase options for providers treating NMIBC

- Future options include more BCG strains, devices, and checkpoint immunotherapies

- Precision testing and therapy may decrease our need for BCG

Presented by: Joshua J Meeks, MD, PhD, Northwestern University, Feinberg School of Medicine, Chicago, IL

Written by: Zachary Klaassen, MD, MSc – Urologic Oncologist, Associate Professor of Urology, Georgia Cancer Center, Wellstar MCG Health, @zklaassen_md on Twitter during the 2024 American Society of Clinical Oncology Genitourinary (ASCO GU) Cancers Symposium, San Francisco, CA, January 25th – January 27th, 2024

Related content: BCG Shortage: What’s on the Horizon to Replace? - Joshua Meeks

References:

- Steinberg RL, Thomas LJ, Brooks N, et al. Multi-Institution Evaluation of Sequential Gemcitabine and Docetaxel as Rescue Therapy for Nonmuscle Invasive Bladder Cancer. J Urol. 2020 May;203(5):902-909.

- McElree IM, Steinberg RL, Mott SL, et al. Comparison of sequential intravesical gemcitabine and docetaxel vs Bacillus Calmette-Guerin for the treatment of patients with high-risk non-muscle-invasive bladder cancer. JAMA Netw Open. 2023 Feb 1;6(2):e230849.

- Boorjian SA, Alemozaffar M, Konety BR, et al. Intravesical nadofaragene firadenovec gene therapy for BCG-unresponsive non-muscle-invasive bladder cancer: A single-arm, open-label, repeat-dose clinical trial. Lancet Oncol. 2020 Nov 27:S1470-2045(20)30540-4.